Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmond Fed President Thomas Barkin said on Tuesday.

"Both sides of our mandate bear watching. Unemployment remains low on a historic basis but has ticked up. Inflation has come down but remains above target," Barkin told the Greater Raleigh Chamber of Commerce in North Carolina.

Interest rates are now "within the range of estimates of neutral," the level that will neither encourage nor discourage investment and spending, Barkin said. "Going forward, policy will require finely tuned judgments balancing progress on each side of our mandate."

The Fed is charged by Congress to maintain maximum employment and stable prices, defined by policymakers as 2% annual inflation. The Fed's preferred measure of inflation, the Personal Consumption Expenditures Price Index, was rising at a 2.8% annual rate as of September, the most recent data available in a series delayed by last fall's federal government shutdown.

"No one wants the labor market to deteriorate much further," Barkin said. "With inflation above target now for almost five years, no one wants higher inflation expectations to get embedded. It's a delicate balance."

The Fed cut its benchmark interest rate by a quarter of a percentage point at its December 9-10 meeting, but officials indicated they were likely to pause further reductions in borrowing costs for now to get a better sense of the economy's direction, a process still hampered by the interruption of statistical reports last fall.

In new economic projections issued after last month's meeting, the median Fed policymaker anticipated only one quarter-percentage-point rate cut in 2026. But opinion was broadly split, with a debate already emerging about where the economy stands after a year of widespread uncertainty stoked by changes in trade, tax and immigration policy, but also of resilient growth driven by an investment boom in artificial intelligence and spending by higher-income consumers.

MIRAN SAYS FED POLICY IS 'CLEARLY RESTRICTIVE'

Fed Governor Stephen Miran, reiterating the stance he brought to the central bank while on leave as a top adviser to President Donald Trump, told Fox Business he felt the Fed could cut rates sharply this year to boost growth without a jump in inflation.

"Policy is clearly restrictive and holding the economy back," Miran said, arguing that "well over 100 basis points of cuts are going to be justified this year."

His outlook makes him the most dovish Fed official by far, with a 2026 rate outlook at least half a percentage point below the rest of his colleagues and a full percentage point under current market expectations.

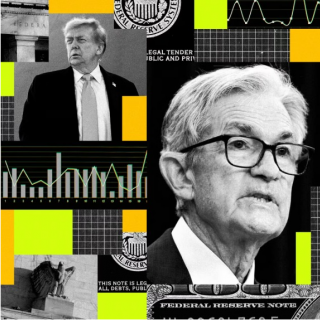

That outlook could shift under a new head of the U.S. central bank, with Trump expected this month to announce a successor to current Fed Chair Jerome Powell, whose term as the central bank's top policymaker ends in May.

In the meantime, Fed officials like Barkin have adopted a more nuanced approach to their analysis of where the economy and monetary policy are likely to head, with an emphasis on coming jobs and inflation data that will continue to fill an information gap left by the shutdown. The Labor Department's employment report for December, due to be released on Friday, will put reporting on job growth and the unemployment rate back on a regular schedule.

Barkin said he is watching layoff data with particular interest to see if firms are shifting out of their current "low-hiring, low-firing" approach to managing employment.

"We're in a low-hiring, low-firing world. That could change. It could change either way," Barkin said.

Barkin said he was also paying attention to consumer sentiment surveys for any signs that households are starting to become more cautious and putting the so-far resilient path of consumption at risk.

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

The Federal Open Market Committee (FOMC) meeting, which will be held tomorrow morning, is a major focus for global financial markets. Investors are awaiting new guidance from the US central bank regar...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...